Credit

Credit

Maintaining a good credit score is vital if you want to apply for loans or credit cards. Learn credit management tips and how to build and maintain good credit.

What Do Lenders Look for When You Apply for a Loan?

The 5 C's of Credit

- Credit History: Your credit history is your track record you've established while managing payments over time.

- Capacity: Lenders need to determine whether you can comfortably afford your payments.

- Collateral: Something of value that you pledge to secure a loan. Items could be a home, land, vehicle, or other item.

- Capital: Capital represents savings, investments and other assets that can help repay the loan.

- Conditions: How you plan to use the funds. Economic conditions or other factors that could impact the borrower's financial condition or ability to pay.

Types of Credit

Revolving Credit: Credit Cards and Lines of Credit

- Gives you a limit on the amount you can borrow.

- Gives you flexible repayment terms.

- Typically, the minimum monthly payment is a small percentage of the outstanding balance.

*As a result, repayment in full may take a very long time when only making the minimum payment.

Installment Loans: College Loans, Car Loan, Home Loan and Personal Loans

- A specific amount at a fixed interest rate and fixed term.

- Contain principal and interest payments - the same amount and the same day each month.

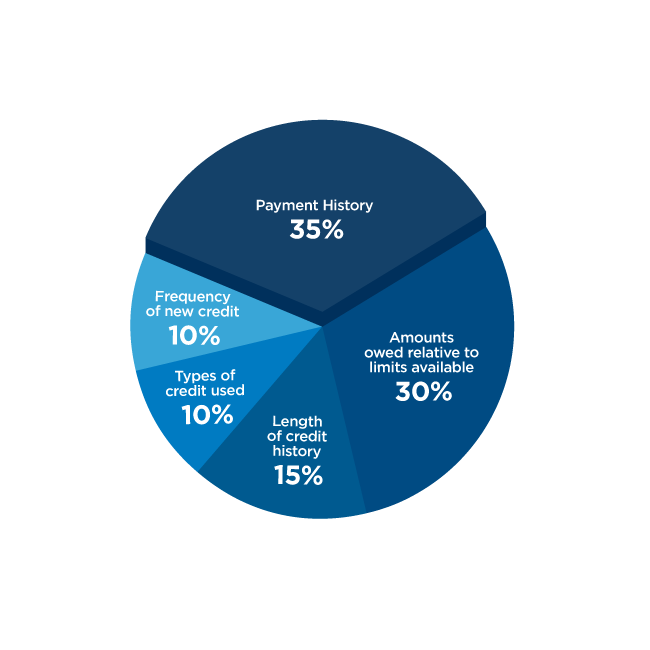

What Makes Up Your Credit Score?

Usually, the higher the credit score, the lower the interest rate.

Why Do I Need Good Credit?

|

Credit Score |

APR |

Monthly Payment** |

|---|---|---|

|

620 - 649 (Fair) |

10.4% |

$531 |

|

740 - 799 (Very Good) |

3.74% |

$457 |

**Rates above are for demonstration purposes only. These are not current rates.

Bottom Line: Assuming the interest rates above, if you have exceptional credit, you could save approximately $74 a month on your car payment. If your credit score is lower than average, you could pay almost $4,440.00 more for your car during that 60-month term!

Ways to Improve or Maintain Your Credit Score

- Pay your bills on time.

- Pay down and pay off revolving debt.

- Ensure credit limits are reported correctly.

- Ensure that derogatory items are removed.

- the oldest credit card to show good history.

![]()

Did You Know?

It is important to check your credit on a regular basis to ensure that your information is correct and report any inaccuracies.

Did you know that you are able to obtain one free credit report annually by going to annualcreditreport.com?

![]()

Credit Tip from Expert

– Kurt Edwards; Chief Consumer Credit Officer

"When consolidating credit, avoid cancelling your oldest credit card to keep it's long credit history on your credit report."